Table Of Content

CNET’s mortgage calculator below can help homebuyers prepare for monthly mortgage payments. A 5/1 ARM has an average rate of 6.89%, a climb of 10 basis points from seven days ago. You’ll typically get a lower introductory interest rate with a 5/1 ARM in the first five years of the mortgage.

Should You Refinance Your Mortgage?

If you find any errors on your credit report, be sure to report them to both the credit bureau and the business that made the error as soon as possible. Both parties must correct the information in order for it to change on your credit report and be reflected in your credit score. We offer a wide range of loan options beyond the scope of this calculator, which is designed to provide results for the most popular loan scenarios. If you have flexible options, try lowering your purchase price, changing your down payment amount or entering a different ZIP code. This link takes you to an external website or app, which may have different privacy and security policies than U.S. We don't own or control the products, services or content found there.

Shop around for a lender

We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. The best type of mortgage loan will depend on your financial goals — while some loan types consistently offer lower rates, they may do so at the expense of higher monthly payments or complicated repayment terms. Weigh the pros and cons of a 15- versus 30-year loan and take time to understand ARM rates and how they differ from traditional fixed mortgage rates before signing on the dotted line.

Vehicle loans

As a result, a 15‑year mortgage has a lower interest rate than a 30‑year mortgage. There are several factors that can influence interest rates, like inflation, the bond market and the overall housing market. So it’s a good idea to check assumptions when you’re comparing rates. To see ours, select the View Legal Disclosures link under where rates are displayed. “We are expecting mortgage rates to fall to around 6.5% by the end of this year, but there’s still a lot of volatility I think we might see,” said Daryl Fairweather, chief economist at Redfin.

Mortgage Rates Today: April 24, 2024—Rates Remain Fairly Steady - Forbes

Mortgage Rates Today: April 24, 2024—Rates Remain Fairly Steady.

Posted: Wed, 24 Apr 2024 07:38:34 GMT [source]

Compare current mortgage rates by loan type

For conventional mortgages, a credit score between 620 and 720 is preferred. The credit score minimum might also depend on your cash reserves, DTI and the loan-to-value ratio. Also, lenders usually reward high credit scores with the lowest available interest rates.

Current Mortgage Refinance Rates By Term

Even so, Cohn expects the Fed to start cutting rates in June or July. In March 2024, the Consumer Price Index rose 3.5% year-over-year. Inflation has slowed significantly since it peaked last year, but it has to slow further before rates will begin to fall. Mortgage rates increased dramatically over the last two years, but they're expected to go down at some point this year.

It’s possible to negotiate certain lender fees—such as getting them to waive the underwriting and processing fees. Fees imposed by the government as well as third-party expenses like taxes, attorney review fees and home appraisals can’t be negotiated or waived. Compare a variety of mortgage types by selecting one or more of the following. That’s why it’s best to connect with one of our experts to let them find your personalized rate. We love helping people understand how rates work and what yours could be.

However, long-term mortgage rates are directly impacted by the bond market. The rate you’re offered on a mortgage will also depend on the lender you work with, its business costs and your financial profile. If you want the predictability that comes with a fixed rate but are looking to spend less on interest over the life of your loan, a 15-year fixed-rate mortgage might be a good fit for you.

A mortgage point is equal to about 1% of your total loan amount, so on a $250,000 loan, one point would cost you about $2,500. While ARM loans typically offer an initially lower rate than a 30-year mortgage, after the fixed period ends, interest rates and monthly payments may go up. Because the adjustment period is unpredictable, ARM loans are seen as a high-risk loan option while 30-year mortgages are viewed as low-risk. If rates have dropped since you bought your home or your credit score has improved, a rate and term refinance may allow you to reduce your monthly mortgage payment.

Today’s mortgage interest rates – April 26, 2024 - CNN Underscored

Today’s mortgage interest rates – April 26, 2024.

Posted: Fri, 26 Apr 2024 12:23:38 GMT [source]

This same time last week, the 15-year fixed-rate mortgage APR was 6.93%. Getting a mortgage should always depend on your financial situation and long-term goals. The most important thing is to make a budget and try to stay within your means.

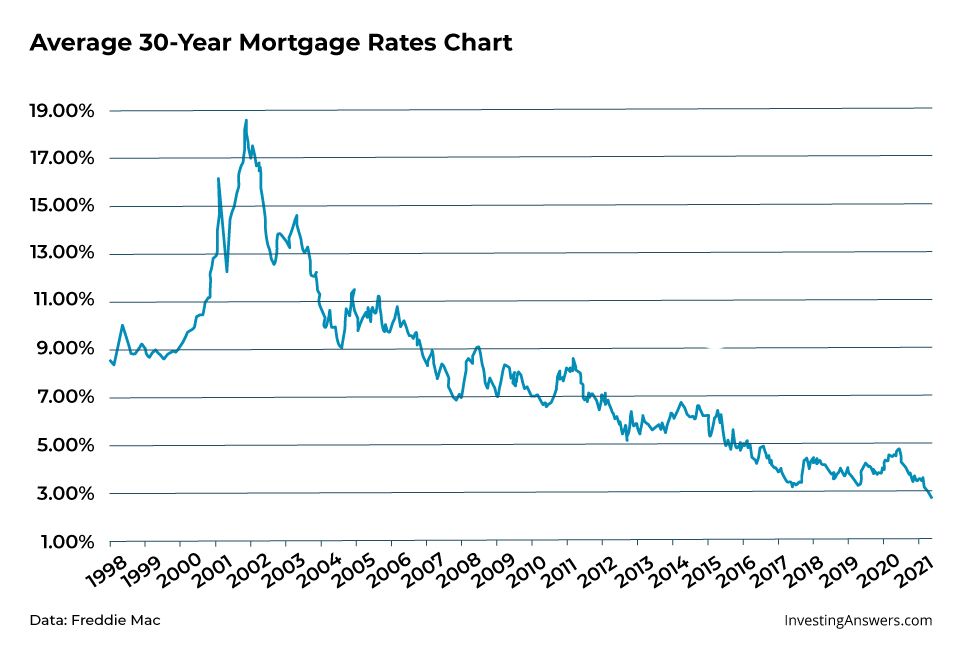

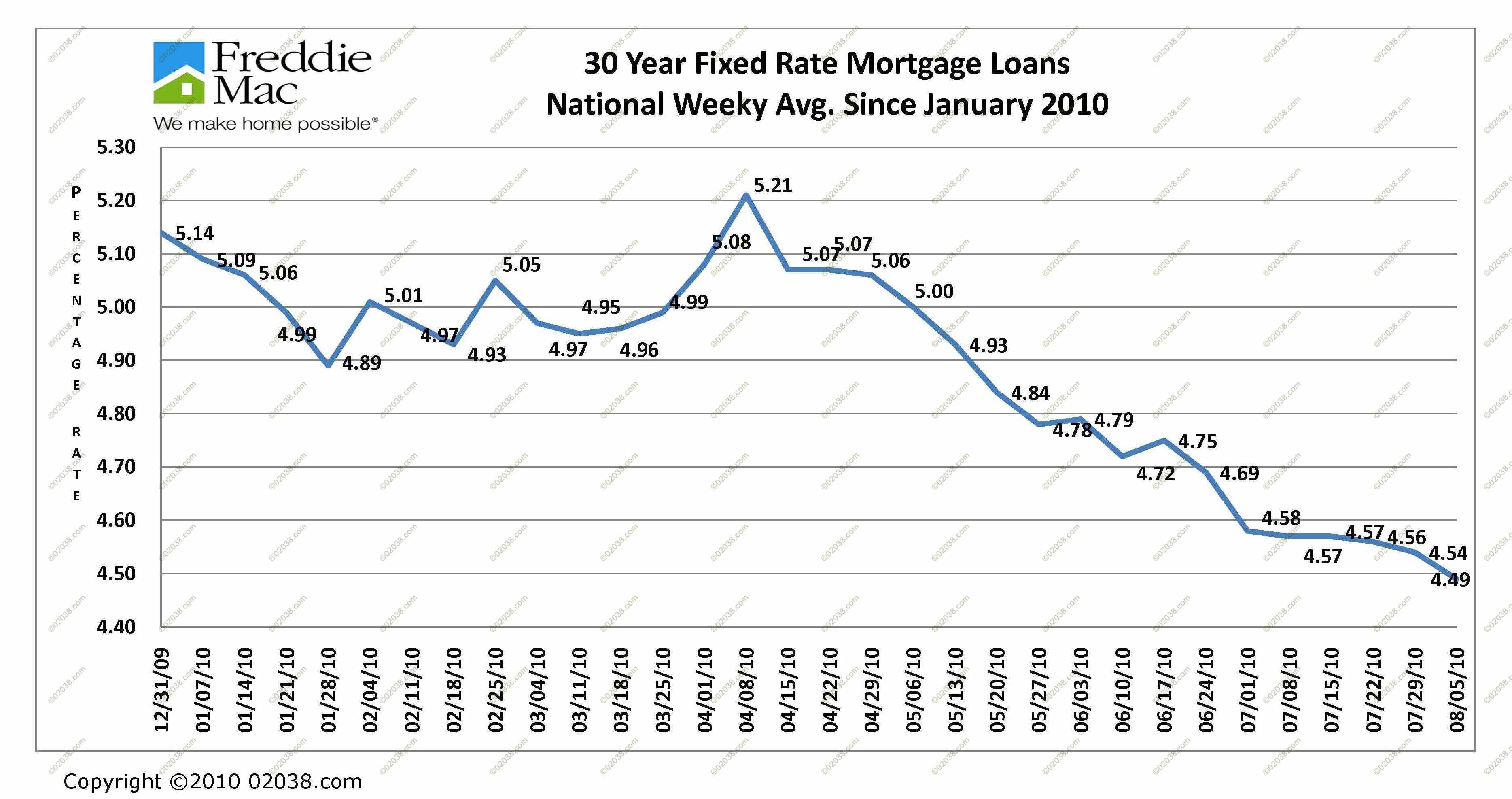

While borrowers shunned ARMs during the pandemic days of super-low rates, this type of loan has made a comeback as mortgage rates have risen. The average rate you'll pay for a 30-year fixed mortgage today is 7.29 percent, up 24 basis points over the last seven days. Last month on the 22nd, the average rate on a 30-year fixed mortgage was lower, at 6.97 percent. Monetary policy is one of the most important drivers of mortgage rates. In particular, following the Great Recession, in economic downturns, the Federal Reserve has been aggressively trying to influence long-term rates in the economy through quantitative easing (QE).

Bankrate is an independent, advertising-supported publisher and comparison service. We arecompensatedin exchange for placement of sponsored products and services, or when you click on certain links posted on our site. However, this compensation in no way affects Bankrate’s news coverage, recommendations or advice as we adhere to stricteditorial guidelines. Bankrate has helped people make smarter financial decisions for 40+ years.

If you lock it in, the rate should be preserved as long as your loan closes before the lock expires. But these predictions are based on assumptions that may or may not pan out. Applying for a mortgage on your own is straightforward and most lenders offer online applications, so you don’t have to drive to an office or branch location.

Your final rate will depend on various factors including loan product, loan size, credit profile, property value, geographic location, occupancy and other factors. Mortgage points, or discount points, are a form of prepaid interest you can choose to pay up front in exchange for a lower interest rate and monthly payment. One mortgage point is equal to about 1% of your total loan amount, so on a $250,000 loan, one point would cost you about $2,500. While it’s important to monitor mortgage rates if you’re shopping for a home, remember that no one has a crystal ball. It’s impossible to time the mortgage market, and rates will always have some level of volatility because so many factors are at play. Learn more about 30-year fixed mortgage rates, and compare to a variety of other loan types.

Average 30-year fixed mortgage rates nearly reached 8% in the second half of 2023, but finally fell below 7% in mid-December. This year mortgage rates remained consistently below 7% until late April, when they crept up to 7.17%. Borrowers should also strive for a good or excellent credit score between 670 and 850 and a debt-to-income ratio of 43% or less. Today’s 15-year mortgage (fixed-rate) is 6.90%, up 0.18 percentage point from the previous week. The same time last week, the 15-year, fixed-rate mortgage was at 6.72%.

No comments:

Post a Comment